Article is courtesy one of our favorite Lenders, Jennifer Cleary with BOK Financial in Frisco.

My job as a mortgage strategist requires me to worry about things and lucky for me it comes naturally. Inflation, Fed policy, mortgage bonds, aging, the heating oil bill, whether the Mets rotation will hold up this season -- it all leaves me in bed staring at the ceiling as the clock hits two in the morning. Yet, one thing that has not troubled my mind is a collapse in home prices in America like we experienced back in the early part of this millennium, when the Great Financial Crisis arrived in 2007. Though every speculative frenzy has the same source, they all are unique in their particulars, and the housing frenzy we just went through is not the housing frenzy we saw in 2007.

A first major difference between now and that earlier housing boom is the crushing lack of inventory of existing homes available for sale. The lack of supply was a notable trait throughout this latest craze, with an average of just 1.22 million homes on the market at any time. Compare this to the go-go years just prior to the Great Financial Crisis: in 2006 and 2007, the average inventory of homes for sale was 3.62 million. In the latest release from the National Association of Realtors, the existing home sales inventory was just 970,000. A lack of supply will help keep a bid under home prices.

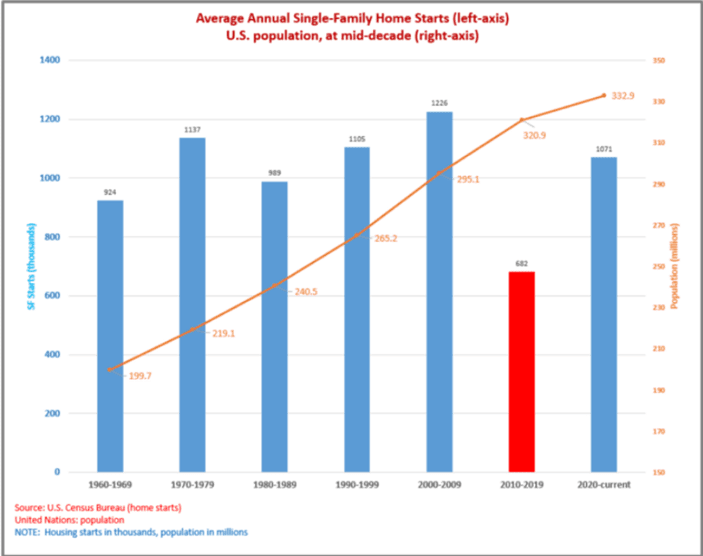

This has been a growing problem for over a decade now, ironically ever since the Federal Reserve instituted its zero interest rate policy in late 2008. So, beginning in 2020, when hordes of Americans fled from one part of the country to another to escape Covid or the lockdowns or their mother-in-law they found, like Jesus, that all the inns were already purchased and they were outbid by piles of gold, frankincense, and myrrh for the others still on the market. Behind this lack of inventory: American home builders, for whatever reason, have significantly reduced the pace of single-family home building.

While the Federal Reserve's various monetary policies over the last decade-plus have sent lending rates to record lows and mortgage bond issuance to record highs, that time frame has been a disaster, plain and simple, for actual home building. During the decade from 2010 until 2019 single-family home building collapsed to an annual rate of just 682,000 new units, the lowest since at least the 1950s, and this on top of a U.S. population 60% larger than when Elvis was making the girls swoon. This has made housing more of a luxury item than ever before. It is estimated that we are three to four million single-family homes short of what we need. Whatever the number may be, it is irrefutable that there is a desperate shortage of homes in this country.

Last, if one looks at the underlying credit characteristics of those granted mortgages during the latest housing boom, the exemplary behavior of lenders stands out. While the housing frenzy in the early part of this millennium saw anyone who could fog a mirror granted a mortgage, this time around lenders kept their wits about them. If one looks at the debt-to-income ratio of new home owners wrapped within conventional 30-year mortgages since the end of 2018, it has averaged 36.5%. Last month it was 39%, well below the 43% level that is considered acceptable. FICO credit scores for the same population of borrowers averaged 753 over the same period; it was 752 last month. Much the same is seen on the Ginnie Mae side of the ledger. So a wave of forced selling by home owners who should not have been given a mortgage to begin with -- as seen earlier this millennium -- does not appear likely.

The above reasons argue against a collapse in home prices. While all real estate is local, as the saying goes, and there are certain areas which will likely see home prices fall more than others (Boise, Idaho, for instance) on a national level I expect home prices to end this year between 0% to 5% lower. I've enough to worry about in life, so no need to pile on where I don't feel it necessary.

Christopher Maloney conducts daily data analysis, watches mortgage-related news, studies economics and speaks frequently with other market professionals to keep a close eye on the mortgage bond market. He provides written market commentary on a daily basis for clients, grants interviews and delivers speeches to express his views on mortgage bonds, the housing market and the economic situation in general. Maloney has an MBA from New York University's Stern School of Business.